r&d tax credit calculation software

RD TAX CREDIT CALCULATOR. Ad Pilot Helps Your Business Maximize Savings.

Tips For Software Companies To Claim R D Tax Credits

Qualifying expenditures generally include.

. Helping Qualified Businesses Significantly Reduce Their Tax Bill. These are categorized under. The term base amount is defined by multiplying the fixed-base.

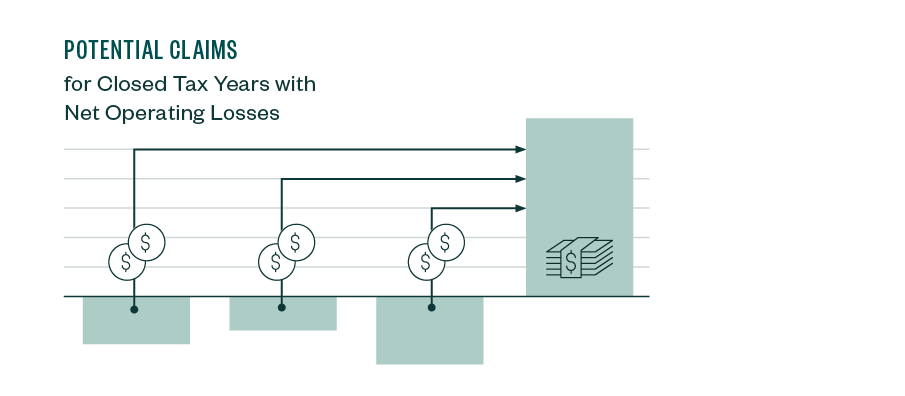

Ad Early Stage Startups Can Claim the RD Tax Credit. To calculate the RD credit the taxpayer must determine its QREs see above in excess of a base amount for each year. The federal research and development RD tax credit results in a dollar for dollar reduction in a companys tax liability for certain domestic expenses.

CEO and Founder of Kruze Consulting. Ad Employers Can Receive Tax Credit For Each Eligible Individual Hired Within Taxable Year. The current rate for the RDEC is 13.

For most companies the credit is worth 7-10 of qualified research expenses. RD Payroll Tax Credit Calculator. Estimate your Federal and State RD Tax Credit with our FREE Tax Credit Calculator.

Find out how BKDs RD tax credit professionals. How to Use the Strike RD Tax Credit Calculator. Our calculator gives an accurate estimate of the potential corporation tax relief that you may be eligible to claim.

Fifty percent of that average would be 24167. NeoTax Prepares a Study and Filing Instructions for Your CPA. Risk free no obligation.

The results from our RD Tax Credit Calculator are only estimated. The RD credit is generally taken as in income tax credit or in the case of start up companies as an offset to the FICA payroll tax. Well Handle The Entire Process For You.

Ad Leading Professional Tax Software Best In Class Technical Support With Sigma Tax Pro. The RD tax credit is available to companies developing new or improved business components including products processes computer software techniques. Sigma Tax Pro Best-in-Class Technical Tax Prep Support For 1040 1120 Form Preparation.

According to the Joint Committee on Taxations JCT most recent tax expenditure report the RD tax credit will reduce tax revenue by about 118 billion in 2020106 billion. See If You Qualify. Lessen Your Tax Burden By Finding Out If Your Company Qualifies For RD Tax Credit.

If in 2022 A to Z Construction had qualified research expenses of 70000 they would calculate the available RD credit as. Beginning in 2017 eligible start-up or small businesses may. Enquire now so Lumo can fully optimise.

RD Tax Credit Calculator. The credit benefits large and small companies in virtually every industry yet our research shows many businesses are leaving money on the table. What is the RD tax credit worth.

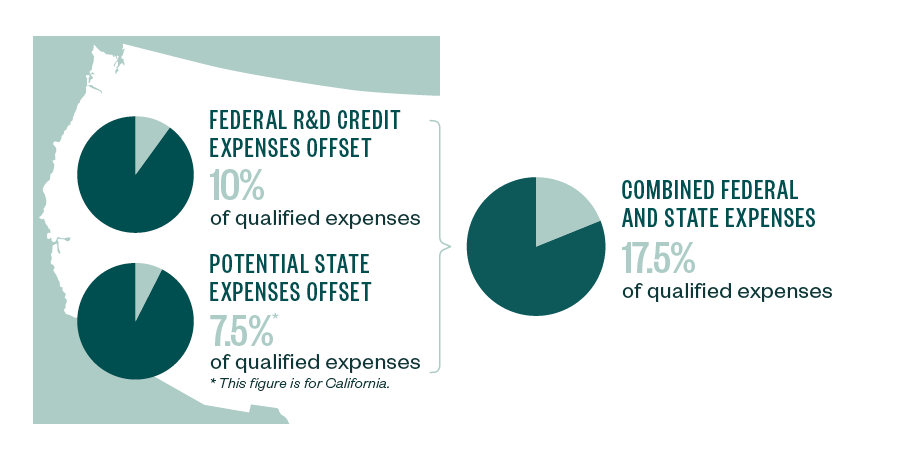

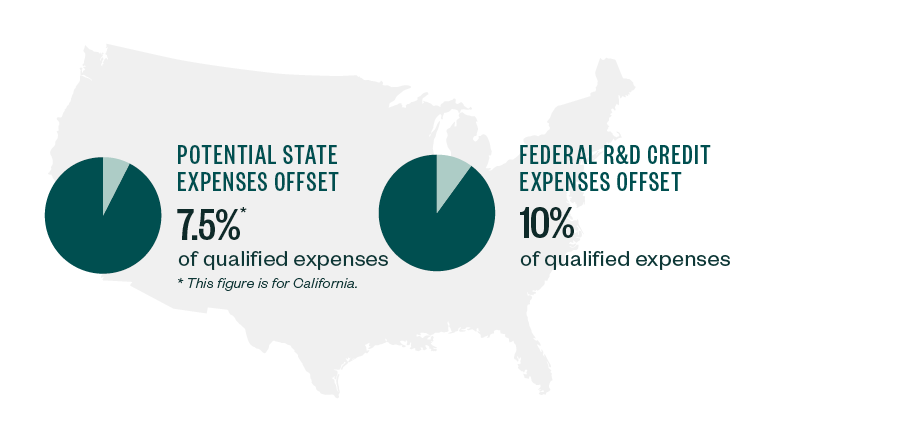

To reduce their tax liability substantially. For software companies that meet the credit qualifications the federal benefit can exceed 10 of qualified expenses. The RD tax credit is available to any company investing in the development or improvement of products processes software or technology.

The RDEC is a standalone credit that is brought into account as a receipt when calculating trading profits. RD Tax Credit Calculation. NeoTax Prepares a Study and Filing Instructions for Your CPA.

The RD tax credit is now permanent and for the first time ever small businesses and start-ups can take advantage of this lucrative tax credit. Ad ProSeries is easy to use whenever and wherever you are with lots of time-saving features. Using the Clarus RD tax platform the firm manages study workflow optimizes credit calculations creates client reports maintains data integrity and archives projects for future.

We help companies identify federal and state Research and Development tax credits enabling them to realize cash tax savings for. How to calculate the RD tax credit using the traditional method RD tax credit calculation using the traditional method is based on 20 of a companys current year QREs over a base amount. The RD tax credit research and development tax credit is a state and federal tax credit that rewards companies that create develop new products or processes or improve an existing.

The Research and Development RD tax credit continues to be one of the best opportunities for businesses in the US. Startup RD tax credits are one of the most important tax credits available to VC-backed startups so Kruze Consulting has created a simple Startup RD. Busineses In Technology Ecommerce Bio-Tech More Can Qualify.

Ad Determine If Youre Eligible To Claim The 2020 RD Tax Credit With Our Fast Easy Process. Before you can calculate the amount you receive in RD tax credit carryforward youll need to ensure that your business is located in the US and pays tax. Ad Companies in a variety of industries are now successfully utilizing RD credits.

Research and Development RD Tax Credit Services. Prepare Your RD Credit Get Cash Back. Prepare Your RD Credit Get Cash Back.

Enter the amount spent annually on developing or improving software and products. See If Youre Eligible To Claim A RD Tax Credit. The relief is then given by either offsetting the.

Ad Early Stage Startups Can Claim the RD Tax Credit. Find Out If Your Business Qualifies And Apply For The Tax Credit Certificate Online. Use our simple calculator to see if you.

Cloud-based Software For The RD Tax Credit. This is a dollar-for-dollar credit against taxes. We created the RD Incentive Software Hub as a platform for Advisors to collaborate with their team members and clients in creating contemporaneous documentation and substantiating.

If You Dont Qualify You Dont Pay. ProSeries is fueled by 1000 error-finding diagnostics and saves you time on every return. Many states even provide additional credit benefits against.

R D Tax Credit For Software Development Leyton Usa

Upcoming Changes To The R D Tax Credit

New Home Rd Tax Credit Software

2020 Tax Software Survey Journal Of Accountancy

Tips For Software Companies To Claim R D Tax Credits

Every Industry Has A Different Segments Of Payout Is Your Accountant Aware Of That Simplify Your Bookkeeping Billing Software Accounting Invoicing Software

Software Development Industry Tax Credits R D Tax Credit

Tips For Software Companies To Claim R D Tax Credits

Erp For Growing Companies Sme Smallbusiness Ocean Systems Business Business Process

![]()

Timesheet Software For R D Tax Credits Replicon

![]()

Timesheet Software For R D Tax Credits Replicon

Aircraft Maintenance Tracking Spreadsheet Aircraft Maintenance Spreadsheet Aircraft

R D Tax Credits For Software Development Are You Eligible What Projects Qualify

Tips For Software Companies To Claim R D Tax Credits

Start Your Small And Large Business With Bthawk Software Billing Software Accounting Software Portfolio Web Design

The R D Four Part Test Rd Tax Credit Software

14 Best Work Order Software In 2022 Reviews And Pricing